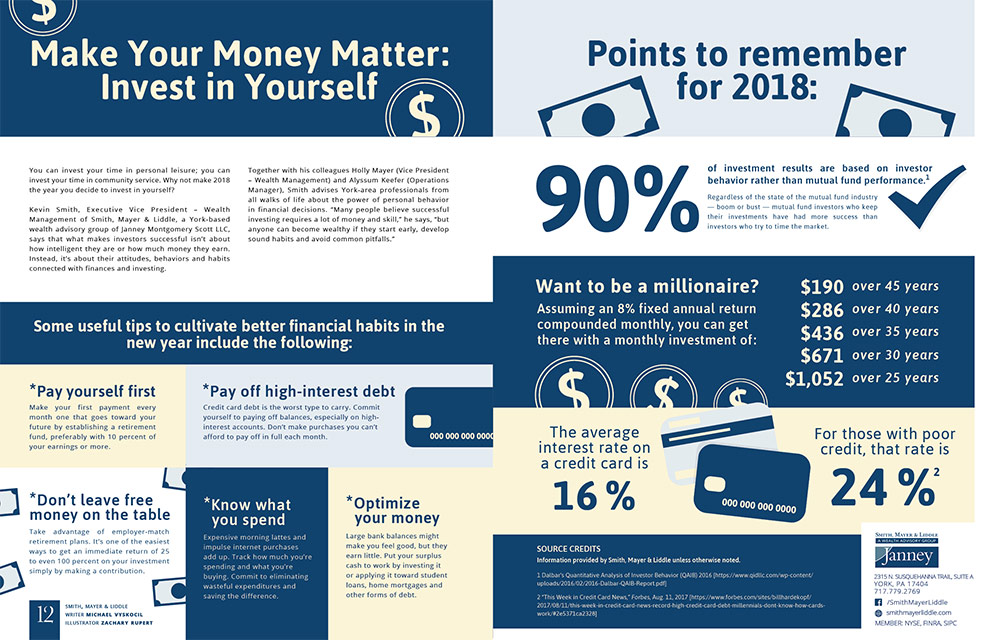

Make Your Money Matter: Invest in Yourself

You can invest your time in personal leisure; you can invest your time in community service. Why not make 2018 the year you decide to invest in yourself?

Kevin Smith, Executive Vice President – Wealth Management of Smith, Mayer & Liddle, a York-based wealth advisory group of Janney Montgomery Scott LLC, says that what makes investors successful isn’t about how intelligent they are or how much money they earn. Instead, it’s about their attitudes, behaviors and habits connected with finances and investing.

Together with his colleagues Holly Mayer (Vice President – Wealth Management) and Alyssum Keefer (Operations Manager), Smith advises York-area professionals from all walks of life about the power of personal behavior in financial decisions. “Many people believe successful investing requires a lot of money and skill,” he says, “but anyone can become wealthy if they start early, develop sound habits and avoid common pitfalls.”

Some useful tips to cultivate better financial habits in the new year include the following:

*Pay yourself first

Make your first payment every month one that goes toward your future by establishing a retirement fund, preferably with 10 percent of your earnings or more.

*Pay off high-interest debt

Credit card debt is the worst type to carry. Commit yourself to paying off balances, especially on high-interest accounts. Don’t make purchases you can’t afford to pay off in full each month.

*Don’t leave free money on the table

Take advantage of employer-match retirement plans. It’s one of the easiest ways to get an immediate return of 25 to even 100 percent on your investment simply by making a contribution.

*Know what you spend

Expensive morning lattes and impulse internet purchases add up. Track how much you’re spending and what you’re buying. Commit to eliminating wasteful expenditures and saving the difference.

*Optimize your money

Large bank balances might make you feel good, but they earn little. Put your surplus cash to work by investing it or applying it toward student loans, home mortgages and other forms of debt.

Points to remember for 2018:

90 % of investment results are based on investor behavior rather than mutual fund performance.1

Regardless of the state of the mutual fund industry — boom or bust — mutual fund investors who keep their investments have had more success than investors who try to time the market.

Want to be a millionaire?

Assuming an 8% fixed annual return compounded monthly, you can get there with a monthly investment of :

$190 over 45 years

$286 over 40 years

$436 over 35 years

$671 over 30 years

$1,052 over 25 years

The average interest rate on a credit card is 16 %

For those with poor credit, that rate is 24 %1

SOURCE CREDITS

Information provided by Smith, Mayer & Liddle unless otherwise noted.

1 Dalbar’s Quantitative Analysis of Investor Behavior (QAIB) 2016 [https://www.qidllc.com/wp-content/uploads/2016/02/2016-Dalbar-QAIB-Report.pdf]

2 “This Week in Credit Card News,” Forbes, Aug. 11, 2017 [https://www.forbes.com/sites/billhardekopf/2017/08/11/this-week-in-credit-card-news-record-high-credit-card-debt-millennials-dont-know-how-cards-work/#2e5371ca2328]

- 2315 N. Susquehanna Trail, Suite A York, PA 17404

- 717.779.2769

Page 12

- 2315 N. Susquehanna Trail, Suite A York, PA 17404

- 717.779.2769